Geofin

June 18, 2020 2024-08-16 12:12Geofin

Publications

Read and download our latest findings, insights and reports

on financial inclusion related issues

GeoFin: Financial Access

& Agent Viability in Nigeria

Financial access is a central precondition for Nigerians' ability to fully participate in the economy and benefit from its growth. The GeoFin tool provides public & private stakeholders with key data and analysis on the current level of financial access as well as opportunities and challenges for improvement.

The following pages offer a guided tour through the studies' key findings and essential analytical tools. At the bottom of the page, you will find a link to a fully interactive research tool that offers more details and additional analytical capabilities. You can also directly jump to the research tool by selecting the last button on the menu to the right.

Financial Access by urban-rurals

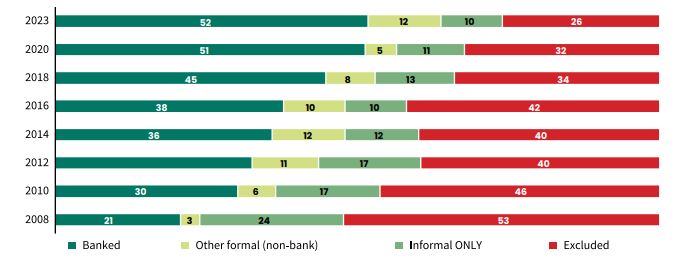

About 63% (31.8 million) of the rural population are

financially included compared to 83% (50.6 million)

of the urban populace. This reflects a 20-percentage

point rural-urban gap in financial inclusion. This is

a notable decrease from the 30percentage point gap in 2020. The narrowing of the rural-urban gap in financial exclusion signifies progress in efforts to promote last-mile access across hard-to-reach areas in Nigeria. Formal financial inclusion in the

urban areas and rural areas stood at 75% (45.9

million) and 51% (25.8 million) respectively.

The tool is driven by high-quality geospatial data & primary research across Nigeria's geopolitical zones

The tool integrates multiple highest-quality data sources. Its foundation is a range of detailed geospatial data across 10 dimensions, including data on population, household expenditure and other key indicators.

To assess economic activity and other drivers of CICO viability, the tool leverages over 100,000 local points of interest, including markets, public employers, medical infrastructure, and more.

The CICO viability simulation engine, which assesses the viability of each individual projected CICO agent, is in addition based on cost & revenue data obtained during over 100 in-depth interviews across all 6 geopolitical zones.

Across all inputs, the resulting descriptive representations, analyses and simulations offer insights at a 1 km² resolution. Differences between states, LGAs and even villages or neighborhoods thereby become visible.

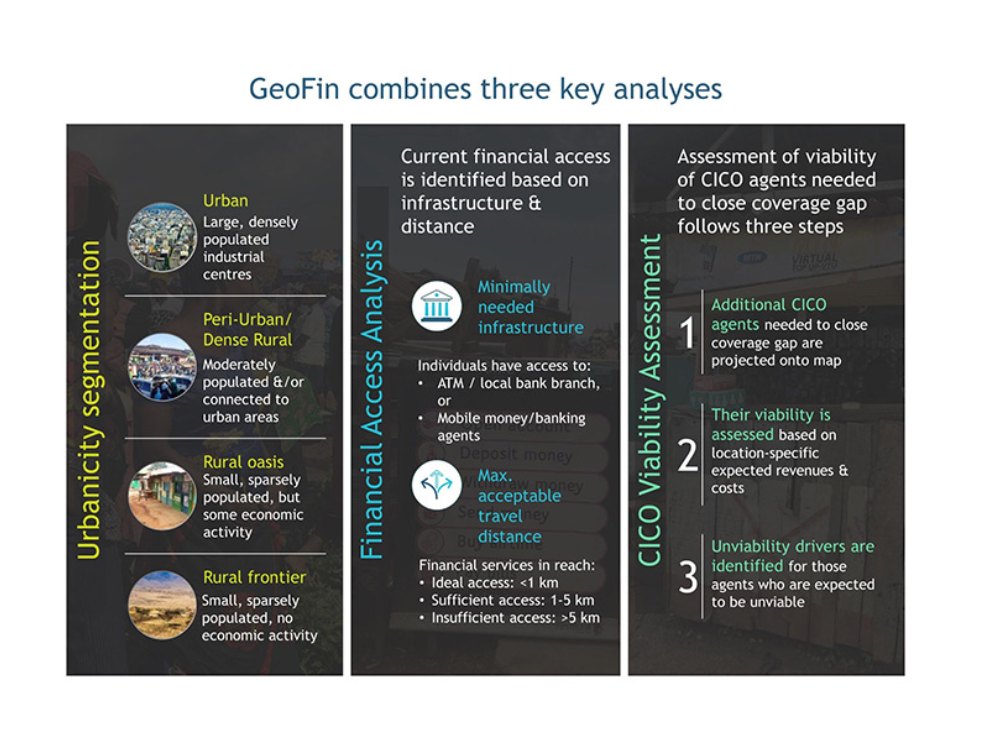

The analyses & assessments integrated here are based on 3 fundamental methodologies