#A2F2023Survey: Unlocking Insights to Accelerate Financial and Economic Inclusion

#A2F2023Survey: Unlocking Insights to Accelerate Financial and Economic Inclusion

On Wednesday, December 13th, 2023, The SIDFS team attended the official launch of the Access to Financial Services in Nigeria (2023) Survey, a significant initiative led by EFInA.The event, held under the theme “Unlocking Insights to Accelerate Financial and Economic Inclusion,” aimed to unveil key findings from the survey and facilitate productive discussions for positive change.

The launch event brought together prominent stakeholders from various sectors of the financial industry, including Oluwatomi Eromosele, General Manager of EFInA; Olu Akanmu, Executive in Residence at the Lagos Business School; Ronke Kuye, CEO of Shared Agent Network Expansion Facilities (SANEF); Dr. Markie Idowu, CEO of Xpress Payments; Jason Lamb, Deputy Director of Financial Services for the Poor at the Bill and Melinda Gates Foundation; Abi Jagun, Senior Programme Officer of Financial Services for the Poor at the Bill and Melinda Gates Foundation; and Eloho Iyamu, Learning & Engagement Officer at SIDFS.

READ ALSO: Understanding Why Women Don’t Save at the Bank and How to Solve It

Here are some key insights from the 2023 Access to Financial Services survey:

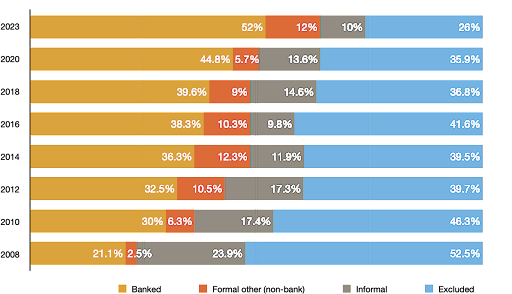

- Decrease in Financial Exclusion: The survey reveals that financial exclusion in Nigeria has decreased to 26% from 32% in 2020, showing progress towards the NFIS 3.0 target of 25% by 2024.

- Formal Financial Inclusion: Formal financial inclusion stands at 64%, up from 56% in 2020. However, further efforts are needed to reach the central bank’s goal of 95% formal inclusion.

- Decline in Reliance on Informal Providers: The proportion of adults relying on informal financial providers dropped from 14% in 2020 to 10% in 2023.

- Urban-Rural Shift: Nigeria has experienced a positive economic shift, with the urban population now accounting for 58.7% and the rural population for 41.3%.

- Agency Banking’s Contribution: The growth of agency banking has made a significant contribution to improving financial inclusion.

- Entrepreneurship Driving Financial Inclusion: Despite earning an average monthly income of N35,000, entrepreneurs have played a pivotal role in driving the expansion of financial inclusion.

Based on the Access to Financial Services (A2F) in Nigeria 2023 Survey findings, several opportunities have been identified to enhance financial inclusion in Nigeria:

- Addressing Women’s Financial Inclusion: Efforts should focus on overcoming the challenges hindering women’s access to financial services.

- Tackling Poverty as a Barrier: Strategies must be developed to overcome poverty, which acts as a barrier to accessing financial services.

- Exploring Growth Prospects: Opportunities lie in the pension, insurance, microfinance, and capital markets sectors, but addressing poverty is crucial for their growth.

- Enhancing Access to Credit: Limited progress has been made in this area, and addressing poverty is fundamental to improving access to credit.

- Leveraging Fintech and Banks: Fintech and banks have the potential to cater to the 47% of adults without transactional bank accounts, presenting an opportunity for expansion.

- Broadband Penetration for Digital Financial Services: Supporting the National Communications Commission’s (NCC) broadband penetration goals will ensure widespread access to digital financial services.

About the Enhancing Financial Innovation and Access A2F Surveys.

The A2F surveys remain the primary source of financial inclusion data that is designed to assess access to and use of financial services for the adult (18+) Nigerian population. The goal of the A2F survey is to strengthen financial inclusion measurement using demand-side data, provide indicators that track the progress and dynamics of the financial inclusion landscape in Nigeria, and provide data to stakeholders including policymakers, private sector players, and researchers for improving the impact of financial inclusion interventions for the poor. Reliable data is key to driving financial inclusion of the unbanked population, improving usage and quality of financial services, improving product design and marketing/segmentation, and guiding financial inclusion policies and strategies.

With over 100 million adult Nigerians, budget and resource constraints make it impossible to collect financial inclusion information on all adults. In line with best practice, the A2F survey therefore samples a representative portion of the population that accurately reflects the target population.

The 2023 survey’s key findings highlight the progress made in financial inclusion in Nigeria, along with opportunities for further development. By addressing the identified challenges and leveraging the potential of technology and strategic partnerships, Nigeria can continue on its path toward achieving greater financial inclusion and economic growth.

Congratulations to the EFInA team on the successful launch of the Access to Financial Services (2023) Survey.

Read the full report here.