5 Key Takeaways from the Small Firm Diaries Nigeria Report

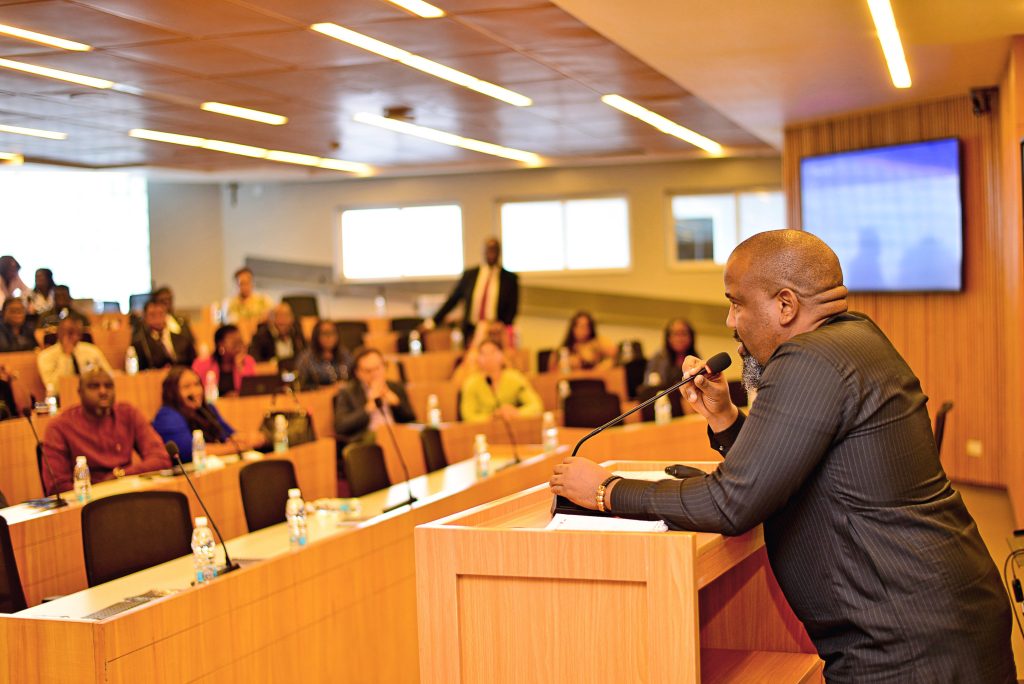

On July 25th, 2023, the New York University team, together with partners such as the National Bureau of Statistics and Lagos Business School, and with the generous support of the Bill & Melinda Gates Foundation, organized a Private Sector Roundtable at the Lagos Business School in Ajah, Lekki, Lagos.

The purpose of this roundtable was to discuss the findings of the Small Firm Diaries Research conducted in Nigeria, with a specific focus on the private sector. Esteemed stakeholders from the commercial banking, microfinance, and FinTech sectors were brought together to hear and engage in discussions regarding the study’s results ahead of the official report launch on July 27th in Abuja, Nigeria.

Subsequently, on July 27th, 2023, the Small Firm Diaries Report was formally launched at the prestigious Transcorp Hilton in Abuja. The launch event included a panel session where experts deliberated on the practical implementation of the research, aiming to provide valuable insights for financial service providers, regulators, and policy makers.

In this article, we discuss key takeaways from the report and recommendations to further drive financial inclusion amongst small firms in Nigeria.

About the Small Firm Diaries

The Small Firm Diaries is a global research project conducted between 2021 and 2023 in seven countries: Kenya, Nigeria, Uganda, Ethiopia, Indonesia, Fiji, and Colombia.

Published by Michelle Kempis, global research manager at Financial Access Initiative Research Center of New York University and Timothy Ogden, managing director at FAI in partnership with the Nigerian National Bureau of Statistics and the Lagos Business School, the report aims to better understand small firms in low-income neighborhoods of developing countries.

In each country, a team of field researchers visited a sample of small business owners in low-income neighborhoods weekly for one full year to collect quantitative and qualitative data on their financial flows. This information sheds light on the economic decision-making, strategies, and constraints of small businesses as they navigate the effects of changes in local and global markets.

Results from the Small Firm Diaries Nigeria study:

In Nigeria, the study collected data from 161 small businesses in urban, suburban, or semi-rural areas surrounding three locations: Enugu, Kaduna, and Lagos, between August 2021 and August 2022.

The study was focused on three industries—light manufacturing, agri-processing, and services—which all play a key role in Nigeria’s economic growth and development.

Here are five key takeaways from the Small Firm Diaries Nigeria Report:

1. Volatility: Nigerian small firms, like those in the other countries studied, experience volatile earnings: both revenue and expenses fluctuate from month to month.

2. Desire for growth and stability: When asked about their vision for their business, a large group of Nigerian firms (44%) said they wanted to both grow and gain stability. This population aspires to grow but does not want to take on the additional risk (they already face a great deal of risk—for instance: fluctuations in demand, rising input prices, supply chain delays, employee issues) that is necessary for rapid growth. They want step-by-step growth that helps reduce volatility and risk.

3. Financial inclusion: Compared with other countries in the study, Nigerian firms have high rates of bank account ownership: 97% of small firm owners in Nigeria have bank accounts for business—more than in Kenya (79%), Colombia (70%), or Indonesia (65%).

However, usage of accounts is less comprehensive, with only 20% of Nigerian firms moving more than three-quarters of their transactions through bank accounts. Cash is still the dominant mode of transaction for this segment.

4. Digital financial services: Nigerian small firm owners use technology — three-quarters use either a smartphone or computer, or both for their business — as well as digital financial services, particularly debit cards, mobile banking, and ATMs. However, they use mobile wallets for business purposes at very low rates.

5. Credit gaps: Data from the study shows that working capital and liquidity are bigger needs to small firms than investment capital. Despite access to finance being a major barrier to firm owners’ vision for success, more than 40% of firm owners in Nigeria say they “rarely” or “never” need a loan, indicating that products in the market are not accessible or don’t meet their needs. Firms closely match revenues and expenses on a month-to-month basis, which also helps confirm that they lack working capital for day-to-day liquidity needs. Firms rarely take on any operating risk or expansion/growth opportunities that could result in negative monthly cash flow.

How then can we improve the situation for small firms in Nigeria? The study further recommends the following:

1. Focused attention on small firms: Small firms, not just micro or larger firms, deserve specific attention. They are distinct from other types of firms, yet are a critical source of jobs and incomes for low-income groups, and make an important contribution to value chains and economic development.

2. Design Policies and Programs around achieving stability: The focus of policies and programs should shift toward reducing volatility and achieving stability. Public and private partnerships to reduce exposure to demand- and supply-side risks as well as training programs focusing on risk and liquidity management would help firms achieve greater stability.

3. Explore Liquidity and Working Capital Lending: New products focused on increasing liquidity are desperately needed. Explore models to increase access to trade credit and leverage information and assets (e.g. stock) to unlock working capital.

4. Develop Support Programs for Employees (Not just firms): While volatility is passed on to employees, there is no guarantee that greater stability for firms will be passed on to employees. Develop programs and policies that directly support the workers in small firms.

To view the full report click here.

5 Key Takeaways from the Small Firm Diaries Nigeria Report

Digital-Financial-Inclusion – and Entrepreneurship-Growth

Digital Financial Inclusion andEntrepreneurship Growth: A Case of Esusu Africa Download

5 Product Design Trends Every Startup Should Know in 2025: A Nigerian Perspective

The Nigerian startup ecosystem is thriving, with innovation and creativity at its core. As we move further into 2025, product design continues to evolve, driven by technological advancements, cultural shifts, and consumer demands. For startups looking to make an impact, understanding these trends is crucial. Here are five product design trends shaping the Nigerian market in 2025. 1. Minimalist Design with a Nigerian Flair Minimalism is a global design trend, but in Nigeria, it’s being reimagined with a local twist. Startups are adopting clean, simple designs infused with Nigerian cultural elements such as vibrant colors, traditional patterns, and indigenous typography. This approach not only appeals to the global aesthetic but also resonates with local audiences. For example, Cowrywise, a fintech startup, has embraced minimalist design while incorporating subtle Nigerian motifs in its app interface. According to a 2024 survey by TechCabal, 64% of Nigerian users prefer apps that are visually simple yet culturally familiar. This trend highlights the importance of balancing global design principles with local relevance 2.Voice-Activated Interfaces With the rise of voice technology, Nigerian startups are integrating voice-activated interfaces into their products. This trend is particularly relevant in Nigeria, where literacy rates vary across regions. According to UNESCO, Nigeria’s literacy rate stands at 62%, making voice technology a game-changer for accessibility. Startups like TalentQL are leveraging voice-activated interfaces to simplify job searches for users with limited literacy skills. Similarly, Farmcrowdy, an agritech platform, has introduced voice commands to help farmers access information about crop management. By 2025, voice technology is expected to power 40% of digital interactions in Nigeria (GSMA Intelligence), making it a must-have feature for startups. 3. Gamification for User Engagement Gamification is gaining momentum in Nigeria as startups use game like elements to enhance user engagement. From loyalty programs to interactive tutorials, gamification is being used across various sectors, including fintech, edtech, and healthtech. A 2024 report by TechPoint Africa revealed that 58% of Nigerian users are more likely to engage with apps that incorporate gamification. For instance, Carbon, a digital banking platform, uses gamified features like progress bars and rewards to encourage users to save money. In the edtech space, Edukoya employs quizzes and leaderboards to make learning more interactive and fun. This trend demonstrates how startups can use gamification to create engaging and memorable user experiences. 4.Modular and Scalable Design In a rapidly changing market, startups need products that can adapt to evolving user needs. Modular design, which allows for easy customization and scalability, is becoming a key trend in Nigeria. This approach is particularly useful in sectors like logistics, e-commerce, and healthcare, where flexibility is essential. For example, Kobo360, a logistics startup, has adopted modular design principles to create customizable delivery solutions for businesses. Similarly, 54gene, a healthtech company, uses scalable design to expand its genetic testing services across Africa. According to a 2024 report by McKinsey & Company, 70% of Nigerian startups are investing in modular design to future-proof their products. 5. Emphasis on Emotional Design Emotional design focuses on creating products that evoke positive emotions and build strong connections with users. In Nigeria, where storytelling and emotional appeal are deeply rooted in the culture, startups are leveraging this trend to create impactful products. By 2025, emotional design is expected to be a key differentiator in the Nigerian market. Conclusion The Nigerian startup ecosystem is a vibrant hub of innovation, with product design playing a pivotal role in this transformation. In 2025, startups that adopt minimalist design, incorporate local elements, leverage voice-activated interfaces, embrace gamification, prioritise modularity, and focus on emotional design will stand out in a competitive marketplace. These trends not only cater to the specific needs of Nigerian consumers but also align with global standards of excellence. Emmanuel Imhodibie

Building an Effective Payment System in Nigeria: Challenges, and Opportunities for Seamless Transactions

Nigeria, Africa’s largest economy, is experiencing a dynamic digital transformation, with its payment ecosystem playing a central role. As the country witnesses the rise of fintech companies, greater smartphone penetration, and a young, tech-savvy population, digital payments are becoming more mainstream. In fact, according to the Nigeria Inter-Bank Settlement System (NIBSS), electronic payment transactions grew by an impressive 298% between 2019 and 2022, reaching ₦387 trillion in 2022. This surge in transactions highlights the need for businesses to adopt efficient and scalable payment systems that cater to the unique demands of the Nigerian market. Challenges in Nigeria’s Payment Ecosystem Despite the growing adoption of digital payments, several challenges still hinder the widespread use of effective payment systems in Nigeria. One of the major issues is infrastructure gaps. Nigeria continues to grapple with an unreliable power supply, limited internet connectivity in remote areas, and inadequate POS terminals. These infrastructure challenges can lead to payment disruptions, creating barriers for businesses that depend on seamless transaction systems. Although Nigeria boasts over 200 million mobile subscriptions (NCC, 2023), which presents a significant opportunity for mobile-based payments, these infrastructure issues remain a key concern. Another challenge is low financial literacy. Despite the rise of digital financial services, a large portion of Nigeria’s population remains unbanked or underbanked. According to EFInA’s 2023 report, 36% of Nigerian adults are financially excluded. Without adequate financial education, these individuals may struggle to understand and adopt digital payment methods, further hindering the growth of a fully inclusive payment ecosystem. Additionally, navigating the complex regulatory landscape presents its own challenge for innovators, requiring careful consideration of compliance and market regulations. Lastly, fraud and security risks are significant concerns as online payments continue to grow. Activities such as identity theft, unauthorised transactions, and phishing scams remain prevalent. Protecting users from these threats is crucial for building trust in digital payment platforms and ensuring the long-term sustainability of the payment ecosystem. Opportunities for Growth in Nigeria’s Payment Ecosystem Despite the challenges Nigeria’s payment ecosystem faces, there are several key opportunities for growth and innovation. One of the most significant areas for expansion is mobile technology, with over 200 million mobile subscriptions in Nigeria (NCC, 2023). Mobile money solutions and USSD payments can serve as a powerful tool to reach underserved populations, particularly those without smartphones or reliable internet connections. Another key opportunity lies in expanding financial inclusion. By focusing on underserved groups, such as rural communities and small businesses, businesses can tap into a large, largely untapped market.The CBN’s Payment Service Bank (PSB) initiative is designed to bring financial services to these populations, opening up opportunities for innovation and partnerships that cater to their specific needs. Additionally, emerging technologies like blockchain, artificial intelligence (AI), and biometric authentication have the potential to transform Nigeria’s payment systems. These technologies can enhance security, reduce fraud, and streamline transaction processes, helping businesses stay ahead of the competition. Another avenue for growth lies in strategic partnerships. Collaborating with established fintech platforms like Paystack and Flutterwave can help businesses optimise their payment systems, offer seamless payment options, improve customer experience, and expand their reach to a broader audience. Solutions for Building an Effective Payment System in Nigeria To succeed in Nigeria’s rapidly evolving payment landscape, businesses need to focus on several key strategies. First and foremost, prioritising user experience is essential. Simplifying the payment process to reduce cart abandonment and offering features like one-click payments and saving customer details for repeat transactions can significantly improve customer satisfaction and encourage repeat purchases. Additionally, businesses should ensure a mobile-first design, as 85% of internet users in Nigeria access the web via mobile devices (Datareportal, 2023). Optimising payment platforms for both smartphones and feature phones will ensure wider accessibility and improve user engagement, particularly in areas where mobile phones are the primary means of internet access. Another critical solution is to educate customers. Providing clear instructions, tutorials, and customer support will help users, especially first-time digital payment adopters, feel confident using the platform. Businesses should make it easy for customers to navigate the payment system and resolve any issues promptly. Finally, it is important to stay agile and adapt to industry trends. Keeping up with regulatory changes and technological advancements—such as the eNaira, Nigeria’s digital currency—will allow businesses to remain compliant and seize new opportunities for growth. Looking ahead, Nigeria’s payment ecosystem is undergoing rapid transformation, driven by innovations like contactless payments, QR codes, and AI-powered fraud detection. By addressing challenges such as infrastructure gaps, fraud, and financial exclusion, businesses can unlock significant growth opportunities within Nigeria’s digital economy. The country’s payment system will continue to play a vital role in driving economic growth, and businesses that adapt to the evolving needs of Nigerian consumers will be well-positioned for long-term success. As Nigeria moves towards a more cashless future, the opportunities for seamless transactions are vast, and businesses that focus on delivering user-centric, secure, and inclusive payment solutions will undoubtedly thrive in this exciting era of digital payments. Emmanuel Imhodibie

Celebrating Zenith Bank’s Product Innovation Team

We extend our heartfelt congratulations to Zenith Bank Product Team for their unwavering commitment to addressing customer needs. Their dedication and hard work, built on in-depth field research and design sessions in our lab, have brought this groundbreaking idea to life. In 2023, Zenith Bank Innovation Team participated in our Product Innovation Lab, where they were immersed in human-centered design principles and collaborative innovation. This experience was instrumental in shaping the EAZY Wallet and underscoring the importance of user-focused solutions. Their success exemplifies the power of innovation and collaboration in creating impactful solutions. We look forward to seeing the continued success of EAZY and the team’s future projects, confident that their ongoing dedication to innovation will drive even more transformative changes in the financial sector.

Leveraging AI in Financial Service Product Design: Enhancing User Experience and Efficiency

In the dynamic financial environment, product designers always seek new creative methods to develop efficient financial services and products tailored to users needs. Artificial Intelligence(AI) has become a powerful tool that can significantly improve the design thinking process ,creating more personalised, user-friendly, and efficient financial products. AI can do this by Personalised Financial Products AI-powered tools can analyse vast customer data, including transaction histories, online behaviour, and demographic information, to identify unique customer segments and their specific needs. This data-driven approach enables financial institutions to tailor their products and services to individual customers, delivering a more relevant and engaging experience . For instance, AI algorithms can create personalised investment portfolios based on individual risk profiles and investment goals. This not only increases customer satisfaction but also enhances the overall financial well-being of users. A real-life example is Carbon (former Paylater), which offers personalised loan and credit products. Predictive Insights and Scenario Testing AI can provide predictive insights and enable scenario testing, allowing product teams to anticipate user behaviour, identify potential pain points, and evaluate the impact of design changes before committing to a final product. This proactive approach helps financial service providers (FSPs) mitigate risks, optimise product features, and ensure a successful launch. For example, AI-powered predictive analytics can help FSPs identify high-risk customers and offer targeted interventions to prevent defaults. This not only reduces financial losses but also improves customer relationships. It is a win-win for both parties. A real-life example is Renmoney, which uses AI-powered predictive analytics to reduce financial risks while enhancing the overall customer experience. Automating Prototype Development AI can optimise the prototype development process by automating various tasks, such as asset creation, layout optimisation, and interactive features. By leveraging machine learning algorithms ,FSPs can generate high-fidelity prototypes more efficiently, reducing the time and resources required to bring new products to market.AI-powered prototyping tools can simulate user interactions, track eye movements, and gather real-time feedback, allowing product teams to refine their prototypes interface, navigation, and overall usability. This iterative approach ensures the final product delivers a seamless, user-friendly end-user experience. In Nigeria, Flutterwave , a leading fintech company, exemplifies the use of AI in automating prototype development, particularly in creating and optimising its payment solutions. Flutterwave streamlines its product development cycle, reduces costs, and ensures its payment solutions are innovative and easy to use, providing a seamless experience for end-users across Nigeria and beyond. Enhancing Transparency and Accountability Transparency and accountability are crucial elements of sustainable finance. AI can help FSPs ensure that their products and services adhere to regulatory requirements and ethical standards.AI-powered systems can enhance transparency and accountability by automating compliance checks, monitoring transactions for suspicious activity, and providing real-time reporting. These platforms employ machine learning algorithms and advanced fraud detection techniques that continuously analyse transaction data. The AI systems assess user behaviour patterns, flagging deviations from typical actions as potential fraud. Moreover, AI-driven analytics can provide deeper insights into financial products &; social and environmental impact, enabling FSPs to measure and communicate their sustainability performance more effectively. In Nigeria, Kuda Bank, often called & quote ;the bank of the free," is an example of how AI enhances transparency and accountability in the financial services sector. To enhance accountability, Kuda Bank uses AI algorithms to monitor real-time transactions for suspicious or potentially fraudulent activities. Kuda Bank & AI-powered platforms provide real-time reporting on compliance and transaction monitoring activities. Fostering Collaboration and Innovation Designing sustainable financial products requires a collaborative effort across the entire financial ecosystem. AI can facilitate this collaboration by enabling the seamless exchange of data and insights between financial institutions, regulators, and other stakeholders within the ecosystem. FSPs can access information on sustainable finance, best practices, regulatory updates, and emerging market trends through AI-powered platforms and data-sharing initiatives. This collaborative approach accelerates the development of sustainable financial products and fosters a culture of innovation and continuous improvement.In Nigeria, the Nigeria Inter-Bank Settlement System (NIBSS) Instant Payment (NIP) platform serves as an example of fostering collaboration and innovation within the financial ecosystem. Building Capacity and Raising Awareness Ultimately, safeguarding data privacy and ethics in using AI in financial services will require a comprehensive strategy that combines policy, regulation, and capacity-building efforts. This includes investing in digital literacy and training programs to empower financial service product designers, policymakers, and technology professionals to understand and navigate the Complexities of AI. Additionally, raising public awareness about the risks and benefits of AI, the importance of data privacy, and ethical considerations will be crucial in building trust and ensuring the responsible development of AI in the financial services sector. In Nigeria, the National Information Technology Development Agency (NITDA) has been actively working to build capacity and raise awareness about data privacy, ethics, and the responsible use of AI in financial services. An example is NITDA’s public awareness campaign on the National Data Protection Regulation, which was launched to educate the public, including financial service consumers, about their rights under the NDPR and the importance of protecting personal data. Conclusion Integrating AI in the product design of financial services has the potential to enhance user experience, efficiency, and sustainability. By leveraging AI-powered tools for personalised product design, predictive insights, automated prototype development, improved transparency and accountability, fostering collaboration and innovation, and building capacity and raising awareness, financial service product designers can create innovative, user-centred, and ethical financial products that drive growth and profitability. As the financial services industry continues to evolve, the role of AI in product design will only become more crucial. Utilising AI capabilities enables FSPs to speed up their product development processes, improve customer interactions, and maintain a competitive edge in a challenging market environment. Tolulope Christos Oyeniran.

Sustainable Business Models for Financial Inclusion : Regulatory Roles

Over the past five years, our “Sustainable Business Models for Financial Inclusion: Regulatory Roles” course has empowered over 215 regulators from approximately 14 MDAs, equipping them to drive positive changes in the regulatory landscape for digital product development in Nigeria. To ensure these insights are put into action, we have launched the SBM: Community of Practice (CoP), an initiative aimed at supporting you in undertaking projects that create a lasting impact within your community. In light of this, Lagos Business School’s Sustainable and Inclusive Digital Financial Services (SIDFS) Initiative is delighted to invite all past SBM course participants to join our Community of Practice. Why join our Community of Practice? The SBM CoP is more than just a continuation of your learning journey; it is a platform that facilitates problem-solving, stimulates learning, promotes professional development, addresses individual questions, and generates essential knowledge for daily regulation and policymaking. Upon joining, you will be assigned to a project based on Capstone submissions. Benefits Collaborative Impact through Project WorkAs a participant, you will have the opportunity to work on meaningful, project-based collaborations that directly address and advance financial inclusion in the communities you serve. By aligning these projects with specific community needs, you’ll ensure that the solutions developed are practical, relevant, and create real, lasting impact. Showcasing Your ExpertiseThe Community of Practice (CoP) will offer you a platform to demonstrate the knowledge and skills you’ve gained from the SBM course. Whether through presentations, workshops, or publishing case studies, you’ll have the chance to highlight your successes and share your innovative solutions with a wider audience. Peer Learning and SupportYou’ll be part of a vibrant community that encourages peer-to-peer learning, where participants openly share their challenges, experiences, and best practices. Regular meetups, both virtual and in person, will provide you with the space to discuss projects, exchange ideas, and gain support from fellow members who share your passion for financial inclusion. Mentorship for GrowthWe will match you with experienced mentors who are experts in financial inclusion, offering you valuable guidance and insights. These mentors will help refine your project strategies, ensuring they align with broader industry goals and have maximum impact. Measuring Impact for Continuous ImprovementTo ensure the effectiveness of the projects within the CoP, we will incorporate clear mechanisms for tracking progress and measuring impact. This will not only help you gauge the success of your initiatives but also provide important data for ongoing improvement and innovation. Recognition and AmplificationYour contributions won’t go unnoticed. Outstanding projects will be recognised and promoted through various channels such as webinars, publications, and partnerships with key stakeholders in the financial inclusion space. This visibility will motivate you and others while showcasing the tangible impact of your work to a broader audience. By leveraging the collective expertise of SBM course alumni, our Community of Practice aims to create a sustained and meaningful impact on financial inclusion. This approach ensures that participants continue to apply and expand their knowledge while making a real difference in the communities they serve. Lead the change by signing up to join our Community of Practice here. For any enquiries, please contact Eloho Iyamu (E: eiyamu@lbs.edu.ng M: 07088803022). We appreciate your ongoing support in building a financially inclusive society and look forward to hearing from you. Eloho Iyamu | Learning and Engagement Manager Sustainable and Inclusive Digital Financial Services (SIDFS) | Lagos Business School | Pan-Atlantic University | Km 22 Lekki-Epe Expressway, Ajah – Lagos | +234- 7088803022 | www.lbs.edu.ng Read about sustainable and inclusive digital financial services in Nigeria