2023 Year in Review: Empowering Nigeria’s Financial Landscape with Inclusive Access – A Recap of SIDFS’ Milestones and Achievements

2023 Year in Review: Empowering Nigeria’s Financial Landscape with Inclusive Access – A Recap of SIDFS’ Milestones and Achievements

As we bid farewell to an eventful year, we can’t help but look back at the remarkable journey we’ve had at the Sustainable and Inclusive Digital Financial Services (SIDFS). With great pleasure, we share with you the incredible achievements and milestones we’ve reached in our mission to catalyse financial inclusion in Nigeria through advocacy, research, and capacity-building activities.

Throughout the year, we have remained steadfast in our dedication to enabling financial service providers to reach underserved individuals and communities with access to financial services, and we are immensely grateful for your unwavering support. Together, we have achieved significant progress and made a tangible impact on the lives of many.

Here’s a recap of some of our proudest moments and initiatives for the year 2023.

- Women’s World Banking Workshop (April 2023): In April, we hosted an empowering 2-day workshop to uplift women in finance. In partnership with Women’s World Banking, the workshop focused on the Savings Mobilization Toolkit, equipping attendees with the knowledge and tools to enhance their financial well-being. Download the toolkit here.

2. CICO Webinar (June 2023): Joining forces with the Economists Impact Unit and IDEO Last Mile Money’s Collective, we conducted an enlightening webinar in June. The webinar presented key findings from the CICO Diagnostic Tool, shedding light on crucial insights for the Nigerian financial landscape.

3. Small Firm Diaries Report Launch (June): Launching the Small Firm Diaries Report in Nigeria was a significant milestone. This report provides valuable insights into the challenges and opportunities small businesses face in Nigeria while guiding financial service providers, regulators, policymakers, and other stakeholders in developing targeted solutions. Read the full report here.

4. Product Innovation Lab Cohort 5 (July – September 2023): The fifth cohort of our Product Innovation Lab took off with great enthusiasm. Engaging 39 participants from 4 organisations, this program focused on understanding Nigerian consumers’ financial needs, behaviours, and motivations The goal is to equip Financial Institutions with the resources required to develop innovative customer-centered products.

4. Product Innovation Lab Cohort 5 (July – September 2023): The fifth cohort of our Product Innovation Lab took off with great enthusiasm. Engaging 39 participants from 4 organisations, this program focused on understanding Nigerian consumers’ financial needs, behaviours, and motivations The goal is to equip Financial Institutions with the resources required to develop innovative customer-centered products.

Since its inception in 2020, the SIDFS Product Innovation Lab has made significant strides in driving financial inclusion and empowering excluded segments. Seventeen (17) FSPs have participated in the lab, resulting in four (4) successful MVPs and five (5) ongoing product developments. 35,955 bank accounts have equally been added to the financial system with over 400 million naira loans disbursed.

5. Sustainable Business Models 4.0 for Policymakers Course (September 2023): In September, we commenced the Sustainable Business Models Course for Policymakers, which aims to enhance regulators’ and policymakers’ understanding of financial service business models. A total of 87 policymakers from various organizations, including CBN, NAICOM, NIMC, NDIC, SEC, and NGX, participated in the course. After the program, policymakers were divided into five (5) different groups and are currently working on their CoP (Community of Practice) based on the capstone projects they submitted. By equipping policymakers with the necessary knowledge, our goal is to drive sustainable growth and progress in the financial sector.

6. AFI Global Financial Inclusion Awards (September 2023):

Since 2013, AFI has been annually recognising member institutions and individual policymakers for their contributions and engagement in the AFI network through the AFI Awards. In September, Professor Olayinka David-West, SIDFS Programme Lead, served as a member of the Grand Jury at the Global Financial Inclusion Awards held in Manila, Philippines. She was also awarded for her exceptional commitment to innovation and the use of technology to advance financial inclusion.

7. Leveraging Data for Financial Inclusion Policymaking Workshop (November 2023):

In November, we hosted an evidence-based workshop, Leveraging Data for Financial Inclusion Policymaking Workshop. This gathering brought together key stakeholders from diverse financial institutions, fostering collaboration and knowledge exchange with 20 policymakers from 10 institutions including NIMC, NDIC, NDPC, NAICOM, SEC, FCCPC, NFIU, NIPOST, CBN, and NCC.

8 . Access to Financial Services (2023) Survey Launch (December 2023):

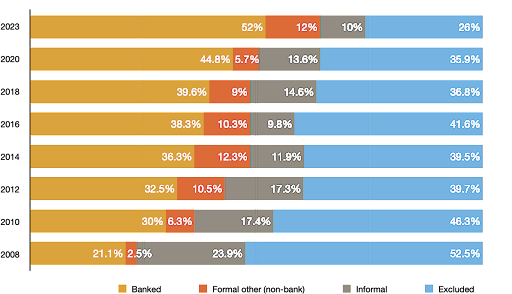

We attended the official launch of the Access to Financial Services (2023) Survey organised by EFInA. This event, titled “Unlocking Insights to Accelerate Financial and Economic Inclusion,” provided invaluable insights into the progress of financial inclusion in Nigeria and the various drivers actively involved in achieving our goals. Read the full report here.

9. Closed Roundtable Discussion on Women’s Financial Inclusion (December 2023): In December, SIDFS in collaboration with The Bill and Melinda Gates Foundation and Women’s World Banking, convened a roundtable to delve into the strategies employed by selected FSPs in achieving their Women’s Financial Inclusion (WFI) objectives in Nigeria. The discussions primarily centered on enhancing the accessibility of digital financial services and a diverse array of financial products for women. The insights gleaned from this roundtable will be shared with the FAWFIN communities of practice for further consideration and action.

10. Ongoing research projects: Naira demonetisation (supply and demand), USSD Failure:

As we enter 2024, our research efforts continue to be dedicated to two crucial areas: the Naira demonetisation (supply and demand) and USSD failure. These ongoing projects aim to delve deeper into these subjects, uncovering valuable insights and contributing to the body of knowledge in these domains. Stay tuned for the exciting findings and conclusive outcomes of these research endeavors.

Reflecting on these accomplishments, we want to express our heartfelt gratitude for your continued support and collaboration. With our SIDFS mandate to conduct research, equip, engage, and inform financial service providers, policymakers, and regulators, we have made significant progress.

Looking ahead to 2024, our commitment to catalyzing financial inclusion through these four pillars remains unwavering. We will continue to advocate for financial inclusion, conduct groundbreaking research, and deliver impactful capacity-building programs. Our objective is to foster sustainable growth and ensure equitable access to financial services for all.

Once again, thank you for being an invaluable part of the SIDFS community. With your support, we can create a more inclusive and prosperous future for Nigeria.